Table of Contents

Toggle💡 Introduction

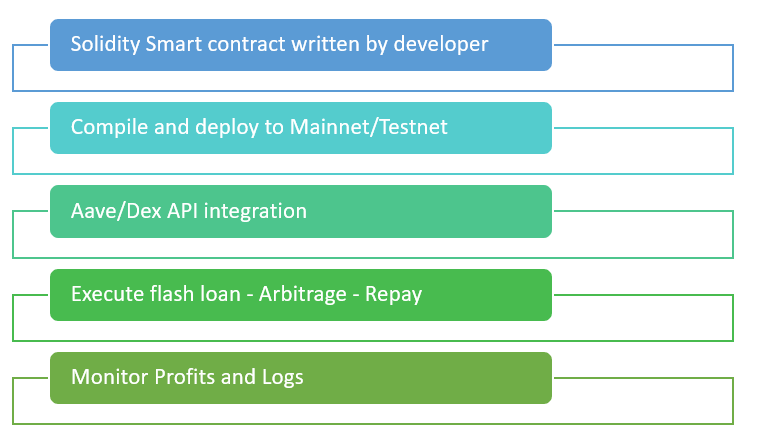

If you want to be a successful flashloan developer, you must first be a skilled Solidity programmer. Flashloans are incredibly powerful but equally risky — one small bug can drain your profits or even your entire contract balance. That’s why understanding Solidity fundamentals is not optional; it’s your first line of defense against costly mistakes.

In this chapter, we’ll break down:

- How Solidity and the Ethereum Virtual Machine (EVM) work

- The structure and lifecycle of a smart contract

- Core data types, visibility, and error handling

- Working with interfaces and external contracts

- Events for logging critical transactions

- Gas optimization for higher arbitrage profits

- Security best practices for DeFi contracts

By the end, you’ll have the coding foundation to architect your own secure and profitable flashloan arbitrage bots.

The Core Idea Behind Flashloans

A flashloan is a special type of uncollateralized loan made possible by the unique nature of blockchain transactions. In traditional finance, you can’t borrow without collateral because there’s a risk you won’t repay. But in DeFi, thanks to smart contracts, the loan and repayment happen atomically — meaning either everything happens together or nothing happens at all.

This is the foundation of how flashloans work: if you can’t repay within the same blockchain transaction, the loan is automatically canceled as if it never happened.

Step-by-Step Mechanics of a Flashloan

- Loan Request

You start by calling a flashloan function from a lending protocol like Aave, DyDx, or Uniswap. You specify the token, the amount, and the action you’ll take. - Smart Contract Executes Your Plan

The protocol transfers the requested amount to your contract. Your contract then uses these funds to perform profitable actions — arbitrage, collateral swaps, or liquidation opportunities. - Profiting from the Loan

The most common use case is arbitrage trading. For example, you might buy ETH cheaply on one DEX and sell it higher on another, pocketing the difference — all in a few seconds. - Repayment with Fees

Before the transaction ends, your contract repays the principal plus the small fee charged by the lender. - Atomic Closure

If repayment fails, the blockchain rolls back the transaction, leaving no debt or loss for the lender.

Why This Works Only in DeFi

The magic of how flashloans work is possible because blockchain transactions are atomic. In a centralized bank, operations happen in sequences that can be interrupted or defaulted on. In DeFi, the entire sequence — borrow, execute, repay — is bundled into one immutable transaction.

Real-World Example

Imagine you spot that DAI is priced at $1.02 on Exchange A and $0.98 on Exchange B. You request a flashloan for 1,000,000 DAI, buy low on Exchange B, sell high on Exchange A, repay the loan plus a small fee, and keep the profit — all in less than 15 seconds.

Risks and Challenges

While how flashloans work makes them appealing, they’re not risk-free:

- Execution risk: If your arbitrage plan fails, the transaction reverts, costing you gas fees.

- Competition: Many bots constantly scan for opportunities.

- Smart contract bugs: A vulnerability could cause unexpected losses.

The Bigger Picture

Flashloans have been used in both legitimate profit-making strategies and high-profile DeFi hacks. This duality makes them one of the most debated innovations in crypto finance. If you master how flashloans work, you unlock a tool that can change your trading game forever.

🖥 3.1 What is Solidity?

Solidity is the programming language of the Ethereum ecosystem. It’s:

- High-level: Easy to read, similar to JavaScript or C++

- Statically typed: Variable types are defined at compile time

- Object-oriented: Supports modular, reusable code

- Deterministic: Every node executes the same code and gets the same result

With Solidity, a flashloan developer can:

- Transfer tokens between wallets and smart contracts

- Interact with DeFi protocols like Aave or Uniswap

- Handle crypto assets securely

- Build logic that runs autonomously without human intervention

⚙ 3.2 Anatomy of a Solidity Smart Contract

Every Solidity contract has a basic structure:

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.20;

contract SimpleExample {

address public owner;

constructor() {

owner = msg.sender;

}

function updateOwner(address newOwner) public {

require(msg.sender == owner, "Only owner can update");

owner = newOwner;

}

}

Key parts:

- Pragma: Defines compiler version

- State variables: Store contract data on-chain

- Constructor: Runs once when deployed

- Functions: Contain logic

- Require: Validates inputs and conditions

🔢 3.3 Data Types & Visibility

Common data types:

uint256: For token amountsaddress: Wallets or contract addressesbool: True/false conditionsstring: Text valuesbytes: Raw encoded data

Function visibility:

- public: Anyone can call

- external: Cheaper for external calls

- internal: Used within contract or inherited contracts

- private: Only within the contract itself

🚫 3.4 Error Handling

A flashloan developer must prevent failed trades from draining capital. Use:

require(condition, "Error")→ Validates inputassert(condition)→ Checks internal logicrevert("Error")→ Manually stop execution

🔗 3.5 Interfaces & External Calls

Flashloan contracts interact with protocols using interfaces

interface IERC20 {

function transfer(address to, uint256 amount) external returns (bool);

}

This allows your bot to talk to:

- Aave lending pools

- Uniswap/SushiSwap routers

- ERC20 tokens

📢 3.6 Events for Logging

Events are essential for debugging and tracking profits here is sample code

event ArbitrageExecuted(address indexed trader, uint256 profit);

🗂 3.7 Structs, Mappings, and Arrays

Data management tools:

- Structs → Store trade info

- Mappings → Track balances

- Arrays → Manage token lists

🏗 3.8 Inheritance & Modularity

A flashloan developer should use modular contracts:

- Ownable.sol → Admin access

- FlashloanLogic.sol → Execution logic

⚡ 3.9 Gas Optimization

Gas efficiency = more profit.

- Use

immutablefor constants - Cache variables in memory

- Avoid unnecessary storage writes

🛡 3.10 Security Best Practices

- Use ReentrancyGuard

- Add onlyOwner modifiers

- Test on Sepolia or Mumbai testnets

Download the full source code on GitHub

Please reach us here.

Chapter 1: Flash Loan Arbitrage with Solidity: The Ultimate Beginner’s Guide

Chapter 2: The Anatomy of a Flash Loan in Solidity

Chapter 3: Solidity Fundamentals for Flash Loan Developers

Chapter 4: Interfaces and Functions — Building Blocks of Flashloans

Chapter 5: Aave V3 Flashloan Developer Guide — How to Harness DeFi Liquidity Like a Pro

Chapter 6: 7 Proven Strategies for Arbitrage Execution Across DEXs with Uniswap & Paraswap