Now that you understand Solidity fundamentals, it’s time to move into the heart of flashloan development: the functions and interfaces that make it all work. In this chapter, we’ll examine the key APIs and contract structures used to implement flashloans — focusing primarily on Aave V3, the most robust and widely used flashloan provider in the DeFi ecosystem.

You will learn:

- The role of interfaces in flashloan orchestration

- How Aave’s flashloan mechanism works

- The required interface:

IFlashLoanSimpleReceiver - Critical functions to implement

- A walkthrough of the complete structure of a flashloan receiver

- Using helper functions for approvals and swaps

- Practical example of a flashloan with Aave V3

By the end of this chapter, you’ll be able to build a flashloan-compatible contract structure using Aave’s framework.

Table of Contents

Toggle4.1 The Power of Interfaces in DeFi

In Solidity, interfaces are like contract blueprints that let your smart contract interact with external protocols, like Aave or Uniswap, without importing their full source code.

Interfaces define only the function signatures, not the implementations.

Example: Aave’s Flashloan Interface

interface IFlashLoanSimpleReceiver {

function executeOperation(

address asset,

uint256 amount,

uint256 premium,

address initiator,

bytes calldata params

) external returns (bool);

}

If you want to use Aave’s flashloan system, your contract must implement this interface and override the executeOperation function.

4.2 Aave Flashloan Architecture

To understand how Aave flashloans work at a contract level, we need to look at the 3 core players:

1. The Flashloan Receiver Contract

This is your custom contract that requests and executes the flashloan logic.

2. The Lending Pool

This is Aave’s contract that manages liquidity and flashloan execution.

3. The Flashloan Executor (User)

This is the account or bot that triggers the flashloan operation from your receiver contract.

4.3 Key Interfaces and Contracts Used in Aave V3

Here are the most important Aave V3 interfaces:

IPool

This is the main entry point for calling a flashloan.

interface IPool {

function flashLoanSimple(

address receiverAddress,

address asset,

uint256 amount,

bytes calldata params,

uint16 referralCode

) external;

}

IFlashLoanSimpleReceiver

Implemented by your contract.

function executeOperation(

address asset,

uint256 amount,

uint256 premium,

address initiator,

bytes calldata params

) external override returns (bool);

IERC20

For token transfers and approvals.

interface IERC20 {

function approve(address spender, uint256 amount) external returns (bool);

function transfer(address to, uint256 amount) external returns (bool);

}

BaseFlashLoanReceiver

Aave offers a base contract that simplifies flashloan development by wrapping boilerplate logic.

4.4 Aave Flashloan Flow in Your Smart Contract

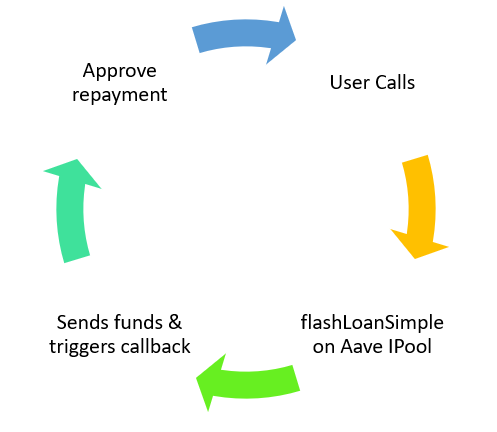

Here’s how the flow looks in your contract:

- User calls

initiateFlashLoan() - Contract calls

flashLoanSimple()on the Aave Pool - Aave Pool sends tokens to your contract

- Aave calls your

executeOperation()function - Your contract performs the logic (arbitrage, swaps, etc.)

- Your contract repays

amount + premium - Transaction completes if repaid correctly

All of this happens in a single atomic transaction.

4.5 Writing the Flashloan Receiver Contract

Here’s a simplified, annotated example of a full flashloan receiver:

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.20;

import {IPool} from "./interfaces/IPool.sol";

import {IFlashLoanSimpleReceiver} from "./interfaces/IFlashLoanSimpleReceiver.sol";

import {IERC20} from "@openzeppelin/contracts/token/ERC20/IERC20.sol";

contract FlashloanArbitrage is IFlashLoanSimpleReceiver {

address public owner;

address public immutable POOL;

constructor(address _poolAddress) {

owner = msg.sender;

POOL = _poolAddress;

}

modifier onlyOwner {

require(msg.sender == owner, "Not authorized");

_;

}

// Initiate flashloan

function startFlashLoan(address token, uint256 amount) external onlyOwner {

bytes memory params = ""; // Optional custom data

IPool(POOL).flashLoanSimple(

address(this), // receiver

token, // token to borrow

amount, // amount

params, // any params to pass to executeOperation

0 // referral code

);

}

// Logic called by Aave during flashloan

function executeOperation(

address asset,

uint256 amount,

uint256 premium,

address initiator,

bytes calldata params

) external override returns (bool) {

require(msg.sender == POOL, "Caller is not Aave Pool");

require(initiator == address(this), "Not initiated by contract");

// TODO: Perform arbitrage logic here

// Example: Call Uniswap to swap token -> another token -> back to token

// Repay Aave

uint256 totalRepayment = amount + premium;

IERC20(asset).approve(POOL, totalRepayment);

return true;

}

}

4.6 Approving the Flashloan Repayment

Aave does not deduct the repayment itself — your contract must explicitly approve the pool to take the tokens back:

IERC20(asset).approve(POOL, amount + premium);

If this is missed, the flashloan will revert — no fees are taken unless fully repaid.

4.7 Passing Custom Parameters

You can pass custom parameters like token paths or DEX addresses using the params field.

Example:

bytes memory params = abi.encode(tokenA, tokenB, dexAddress);

In executeOperation, decode them:

(address tokenA, address tokenB, address dexAddress) = abi.decode(params, (address, address, address));

This allows your contract to remain flexible and data-driven.

4.8 Add DEX Swap Logic (Preview)

In the next chapter, you’ll add logic like:

IERC20(tokenA).approve(uniswapRouter, amount);

uniswapRouter.swapExactTokensForTokens(...);

For now, you only need to understand that this logic goes inside executeOperation().

4.9 Key Safety Checks

Before deploying a flashloan contract, always validate:

msg.sender == POOLinsideexecuteOperation- The initiator is your contract

- The repayment amount is available and approved

- Your logic can handle errors and still clean up

4.10 Summary Checklist

✅ Use IPool to call flashLoanSimple()

✅ Implement IFlashLoanSimpleReceiver

✅ Use executeOperation() to define logic

✅ Approve repayment within the function

✅ Add security and input checks

✅ Keep your contract modular and parameterized

Conclusion

You’ve now seen the complete skeleton of a flashloan receiver contract. This is your launchpad for building complex arbitrage bots. In the next chapter, we’ll explore Uniswap, Paraswap, and DEX interaction logic, and how to chain profitable swaps with the borrowed funds.

Download the full source code on GitHub

If you’re interested, you can read other chapters here.

Chapter 1: Flash Loan Arbitrage with Solidity: The Ultimate Beginner’s Guide

Chapter 2: The Anatomy of a Flash Loan in Solidity

Chapter 3: Solidity Fundamentals for Flash Loan Developers

Chapter 4: Interfaces and Functions — Building Blocks of Flashloans

Chapter 5: Aave V3 Flashloan Developer Guide — How to Harness DeFi Liquidity Like a Pro

Chapter 6: 7 Proven Strategies for Arbitrage Execution Across DEXs with Uniswap & Paraswap