Table of Contents

Toggle🧠 What’s a Flashloan? And Why Should You Care?

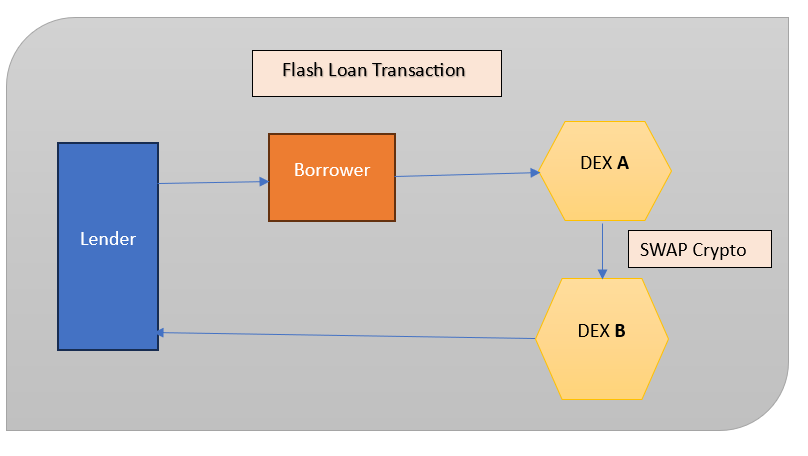

Flash loans in DeFi are one of the most powerful and controversial tools in DeFi. Think of them like instant, zero-collateral loans that only exist within one blockchain transaction. If everything goes right in the same transaction, the loan is repaid. If anything fails, the entire transaction is reverted—no harm done.

Flashloans are a revolutionary financial primitive in decentralized finance (DeFi) that allow you to borrow any amount of crypto without collateral, provided the loan is repaid within a single transaction block.

But why are they a big deal?

Imagine borrowing $1,000,000 for 0 seconds, using it to profit from price mismatches, and repaying instantly—without ever needing to own the capital.

That’s flashloan arbitrage.

🧪 Real-Life Use Case: Arbitraging DEXs

Arbitrage is the act of buying a token at a lower price on one exchange and selling it at a higher price on another—profit from price discrepancies.

In DeFi, DEXs like Uniswap, Sushiswap, and Curve may have slightly different prices for the same token. Flashloan-based arbitrage allows you to:

Let’s say Token A is selling for:

- $99 on Uniswap

- $101 on SushiSwap

You could:

- Borrow Token A via a flashloan.

- Buy cheap on Uniswap.

- Sell high on SushiSwap.

- Repay the loan.

- Keep the profit (minus gas & fees).

🧠 The Concept Behind Flash Loans

At their core, flash loans allow users to borrow any amount of crypto without collateral, under one crucial condition: the loan must be repaid within the same blockchain transaction. If the borrower fails to return the loan by the end of the transaction, the entire operation is reverted as if it never happened.

This all-or-nothing principle is enforced by smart contracts, making flash loans one of the most fascinating innovations in decentralized ecosystems like Ethereum.

🏦 Why Do Flash Loans Exist?

The DeFi space is all about permissionless finance—no gatekeepers, no credit checks. Flash loans align perfectly with that philosophy, enabling:

- Arbitrage Trading

Exploit price differences between decentralized exchanges (DEXs) by buying low on one and selling high on another—all within a single transaction. - Collateral Swaps

Switch the collateral behind a loan in lending protocols without closing the original position. - Self-Liquidations

Automatically repay your own loan positions to avoid liquidation, often at a lower cost.

🛠️ Technologies You’ll Use in This Series:

- Solidity (for smart contracts)

- Aave Protocol V3 (to issue the flashloan)

- Uniswap + Paraswap (for swaps)

- Hardhat (for local testing)

- Remix (for quick contract deployment)

- Ethers.js (for scripting deployments)

🧱 Step-by-Step Roadmap (Bookmark This!)

In this blog series, you’ll learn how to:

- Understand flashloan architecture

- Write and deploy your first arbitrage contract

- Connect with DEX aggregators like Paraswap

- Simulate arbitrage paths and profits

- Execute on-chain tests using Hardhat

- Protect your logic from slippage & MEV threats

- Monitor profitability before executing transactions

💰 Why Flashloans Matter

Traditionally, traders needed large amounts of capital to exploit price inefficiencies across decentralized exchanges (DEXs). Flashloans remove this barrier, letting anyone with the technical know-how build strategies that require temporary access to huge liquidity.

Key benefits:

- No upfront capital needed

- All on-chain and permissionless

- Low risk due to atomicity (either all steps execute or none do)

🚀 Why Combine Flashloans + Arbitrage?

This combo creates a unique opportunity: risk-free capital-free trading.

With precise timing and smart contract automation, you can exploit micro-opportunities that exist for mere seconds in blockchain ecosystems. It’s like high-frequency trading, but decentralized.

⚠️ Risks and Considerations

- Gas Fees: Ethereum gas can eat into profits quickly.

- Timing: The window for successful arbitrage is incredibly short.

- Competition: Bots and MEV (Miner Extractable Value) frontrunners are always lurking.

Still, if implemented correctly, flash loans can be the DeFi equivalent of wielding a financial superpower.

💡 Key Takeaways

- Flash loans are zero-collateral, instant loans in DeFi.

- They’re used for arbitrage, refinancing, and liquidation avoidance.

- Must be repaid in the same transaction or the operation fails.

- Require smart contract development skills and careful risk management.

✅ Final Thoughts

Flashloans are an open door to advanced trading and DeFi development. This chapter sets the foundation. The next one dives into Aave Flashloan Mechanics and how to integrate their interface in Solidity.

Stay with us, because the deeper we go, the more powerful your toolset becomes.

If you’re interested, you can read other chapters here.

Chapter 1: Flash Loan Arbitrage with Solidity: The Ultimate Beginner’s Guide

Chapter 2: The Anatomy of a Flash Loan in Solidity

Chapter 3: Solidity Fundamentals for Flash Loan Developers

Chapter 4: Interfaces and Functions — Building Blocks of Flashloans

Chapter 5: Aave V3 Flashloan Developer Guide — How to Harness DeFi Liquidity Like a Pro

Chapter 6: 7 Proven Strategies for Arbitrage Execution Across DEXs with Uniswap & Paraswap